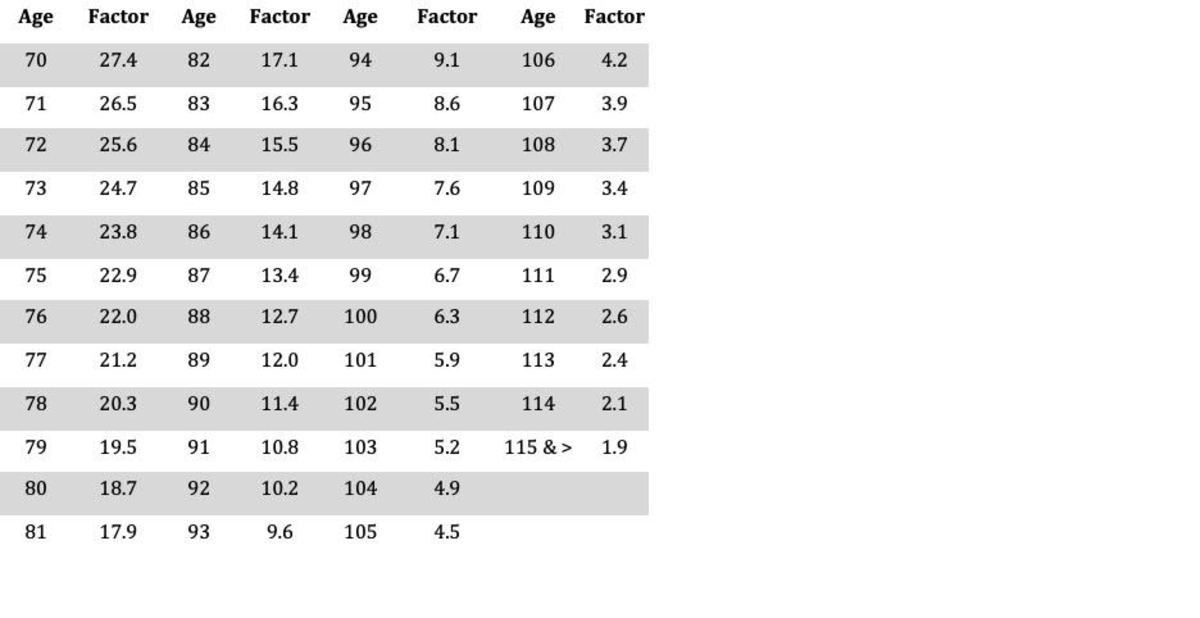

single life annuity table

Lock in the current interest rates for the annuity to be received later. Various proposals have been made to adopt a linear system.

Latest Irda Claim Settlement Ratio 2019 Data Life Insurance Life Insurance Life Insurance Companies Best Life Insurance Companies

In the United States an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life.

. Why retire with Old Mutuals Max Investments Flexible Plan Life is flexible. A joint-life annuity provides you with an income for life but then transfers to your spouse partner or any other chosen beneficiary when you die and pays them a regular income for the rest of their lives. The good news is that Max Investments Flexible Retirement Annuity Plan a retirement annuity from Old Mutual is designed to help you save for retirement when you can how you can.

Example notation using the halo system can be seen below. The estimate of life expectancy is based on the SSAs Social Security Administration life expectancy table or depending on the state another eligibility table specific to its Medicaid program may be used. Fixed annuity contracts provide guaranteed retirement income payments.

Two life rates are capped at 88 for annuitants above 90 and are graduated downward in a similar way. The term of the annuity must be fixed and must be equal to or shorter than the owners Medicaid life expectancy. Cash value or account value is equal to the sum of money that builds inside a cash-valuegenerating annuity or permanent life insurance policy.

Or it can be used to pay. IDOI staff will provide information about various types of insurance from health and homeowners to auto and life. 3 Group life insurance and annuities used to fund prearranged funeral contracts.

2 The first table of suggested rates in 1927 was based on a residuum target of 70. Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life tables. When an annuity matures the income is usually distributed as a series of payments on a set schedule.

Table of Contents. The annuity options could vary from single life to a joint life. Single premium plan to get guaranteed income for life with the option to defer income by upto 10 years.

Permanent life insurance policies may accumulate. This figure is determined by the life expectancy table published by the Chief Actuary of the Social Security Administration or by a states specific life expectancy table as outlined in each states Medicaid manual. While many states allow annuities to be shorter than the life expectancy of the person receiving annuity payments Oregon is an exception.

The actuary may use a single method of analysis for all reserves and other liabilities or a number of different methods of analyses for each of several blocks of business. Trusted by over 2 million customers and with 25 million annuity contracts and life insurance policies. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream.

Since the cash option and annuity option award different payouts it only follows that your tax liability federal tax state tax will also be different for both. Multi-year guarantee annuity and single premium immediate annuity. BEST CASH-OUT OPTIONS ANNUITY.

Group life insurance or group annuity certificates marketed through direct response solicitation shall be subject to the provisions of Section 7. Additional Assumption for Deferred Gift Annuities. Methodology being a Top Annuity Company.

7 Analysis of Life Health or PropertyCasualty Insurer Cash Flows. Annuity of 100 per annum payable annually at for such time as a person aged 65 survives a person aged 60 is 17760 determined as follows. Typically these are offered as structured products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurerThere are many different varieties of.

An Allan Gray fund and an Investec fund all in a single Max. Single life rates for annuitants between ages 81 and 89 are graduated downward from the rate cap. In the table below are types of annuities based on the features and meeting the requirements by the certain annuitants.

Traditional notation uses a halo system where symbols are placed as superscript or subscript before or after the main letter. Annuity plan can cover either single or joint life Flexible payout options to suit your need 2. Both products require a premium which is what you initially pay to purchase the annuity contract or the life insurance policy.

If you choose a single-life payout the death benefit will be. A spousal benefit provision allows the spouse to continue the contract after the contract holder dies. Use the life expectancy listed next to the owners age as of his or her birthday in the year of death.

Joint and Survivor Annuity Factor from Example 3 149264 Single Life Annuity Factor age 60 From Table S42 131504 Required Annuity Factor 149264 131504 17760. What our Mega Millions tax calculator provides is a quick overview of the gross and net after taxes winnings youd receive for both options allowing you to make a more. Life insurance benefits on the other hand are generally distributed in a lump sum to the beneficiary of the policy.

Besides there are annuity plans which offer flexibility wherein the annuity payouts yearly will. Reduce the life expectancy by 1. Tax benefits on premium paid us 80CCC of Income Tax Act 1961.

What are fixed annuities paying. Single insurer in connection with enrolling that individual. August 11 2022 The Illinois Department of Insurance IDOI table is in the Lieutenant Governors tent at the 2022 Illinois State Fair.

The top fixed annuity rates as of September 2022 are 480 for a five-year fixed annuity 465 for a seven-year annuity and 460 for a three-year fixed annuity. The Accumulation or Account Value in a lump sum. The actuary should consider using cash flow testing and should refer to ASOP No.

A new annual income amount will be recalculated based on the remaining income values and. Divide the account balance at the end of 2021 by the appropriate life expectancy from Table I Single Life Expectancy in Appendix B.

Where Are Those New Rmd Tables For 2022

Your Search For The New Life Expectancy Tables Is Over Ascensus

Some Year End Charts And Tables Asking Some Big Questions About What Comes Next In 2022 Stock Market History Stock Market Us Stock Market

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Pin By Sarah Mae Mann On Beautiful Thoughts In 2022 Words Thoughts Word Search Puzzle

May Be Getting A Little Obsessed Accident Insurance Insurance Policy Insurance Quotes

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Government Life Annuity Commutation Tables For Single And Two Joint Lives And Three And Four Joint Lives Walmart Com Book Publishing Reference Book Language Study

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Qlacs Can Deliver Late In Life Income Income Single Mom Budget Canning

Annuity Mortality Table Single Life Annuities Retirement Planning

Lic New Plan Bachat Plus Illustration How To Plan Investing Illustration Example

Insurer Wise Latest Health Insurance Incurred Claims Ratio 2016 17 Details Health Insurance Companies Best Health Insurance Health Insurance